Click to download Journal Form with Analysis Fields to be used in posting Vacancy Savings. Account coding and use of analysis fields set out below:

Central Charge

Dr 4321-81507 (Central vacancy savings)

where 4321 represents the cost centre in the College Allocation Unit.

The charge is applied each month.

Re-allocation to units

Dr 1234-81508 (Local vacancy savings)

Cr 4321-81509 (Local vacancy savings recharge)

where 4321 represents the cost centre in the College Allocation Unit & 1234 represents the local cost centre.

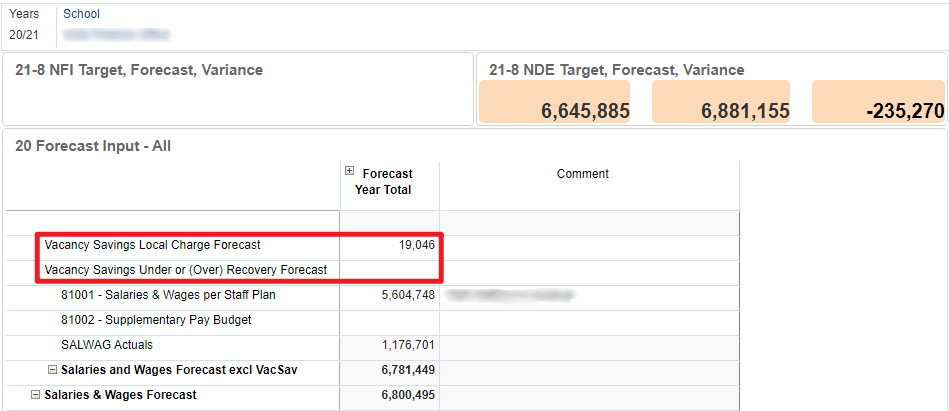

This journal must balance - it is to re-allocate charges to units and by definition must total to 0. Depending on the local circumstances, FMs may be re-allocating more (ie over-recovering) or less (under-recovering) than the Allocation Unit has been charged, which will leave a net positive or negative amount in the Allocation Unit, but either way the re-allocation journal itself must be balanced.

For the credit side of the journal, the re-classification from the college/central unit to the local area, the text ‘Vacancycge’ should be input in the analysis 4 field, this will then label these as ‘Vacancycge’ when the SALWAG actuals are loaded to PBCS, on the Actual V Plan reports.

EF Cost Centre

Where an EF cost centre is used, it is to be entered as the Job Code in the journal, in addition to the regular code being entered as the cost centre. E.g. 4321 as the cost centre plus EF4321 as the job code.

Person Identifier

Where an employee number is known this should be populated in the analysis 3 field for the local vacancy savings charge (debit). Where the employee number is not yet know, analysis field 3 should be populated with the ‘person’ code dropping the ’18.’, for example person code ’18.S086.001’ will become ‘S086.001’